You’ve had a killer quarter. The P&L is glowing, client work is humming along, and on paper, your agency is thriving. But when you log into your bank account? There’s barely enough to cover next week’s payroll.

Does this sound familiar?

This is the profit paradox. When a business is technically profitable, but still struggling to pay its bills. And it’s one of the most frustrating and dangerous situations a service-based agency can face. You’ve done the work, sent the invoices, maybe even celebrated the projected revenue… but the cash just isn’t there.

Understanding why this happens starts with one simple truth: profit is an opinion; cash is a fact.

What’s the difference? Profit is opinion, cash is fact

A lot of business owners assume profit and cash flow are basically the same thing. But in practice, they can tell wildly different stories. And when you're running a service-based business with payroll, vendor bills, and project expenses, that misunderstanding can come back to bite you.

Understanding profit

Profit is an accounting metric. It’s the result of this simple equation: Revenue minus Expenses.

Sounds straightforward, right? But here’s the complication: revenue is often recorded the moment you send an invoice, not when the money actually hits your bank account.

So if you bill a client $40,000 today, your profit and loss (P&L) statement might already count that as income, even if the client won’t pay for another 60 days. On paper, it looks like your agency is doing great. In reality, your bank account might still be dangerously low.

That’s why profit is often called a measure of theoretical success. It tells you whether your business model is viable over time. But it doesn’t guarantee you’ll have enough cash to make payroll next week.

Understanding cash flow

Cash flow, on the other hand, is all about what’s actually moving through your business in real time. It tracks the money coming in from client payments and going out to cover expenses from salaries to software subscriptions to rent.

It’s less about how your business looks on paper and more about how much money you have available right now. Even a profitable agency can run into trouble if clients pay late or expenses pile up faster than income.

So here’s the core distinction:

Profit shows potential. Cash flow shows reality.

And if you’re not tracking both, you can quickly run into problems.

Top reasons your profitable agency is cash-poor

Even if your agency is doing great work and billing well, these four issues can leave you strapped for cash:

1. The waiting game: Slow-paying clients

You delivered the work. You sent the invoice. But you’re still waiting.

Net 30, 60, or 90-day terms might look fine on your books, but they delay actual cash in the bank. And when clients pay late? The delay grows. Meanwhile, your team’s working, tools are billing, and rent’s due, whether or not the client has paid.

Accounts receivable is often the largest “hidden” line item stealing your agency’s liquidity.

2. The long haul: Extended project timelines

Long-term projects can be profitable, but they’re also cash-hungry.

You’re paying designers, developers, and project managers weekly. You’re investing in tools, meetings, and maybe even subcontractors. But if you only invoice at the end, you’ve just fronted weeks or months of costs.

That “work in progress” becomes a silent drain. You’re profitable… eventually. But you’re cash-negative until that time comes around.

3. The upfront investment: Paying before you get paid

Agencies often spend money on behalf of clients before they ever see a cent. This applies in so many ways. Think of things like:

- Paid ads or media buys

- Freelance contractor invoices

- Stock photos, fonts, or video licenses

- Software tools and platform fees

If your contracts don’t account for these out-of-pocket expenses, you’re footing the bill and gambling on reimbursement. That’s risky even when clients pay on time.

4. The rollercoaster: Unpredictable revenue cycles

One big project might carry your entire month (or quarter), making your P&L sparkle.

But what happens next month, when that client goes quiet and you don’t have another client lined up to take their place? Your fixed costs like rent, salaries, and software don’t take breaks.

This is the double bind: revenue is uneven, but expenses are steady. And without a buffer, the dry spells can, ironically enough, drown you.

How to bridge the gap: 4 steps to healthy cash flow

Profit’s important, but cash flow keeps your business alive. Here’s how to turn things around:

1. Speed up your invoicing and collections

Invoice faster. Get paid sooner. That’s the mantra.

- Invoice immediately when work is delivered, not at the end of the month.

- Accept digital payments through online payment gateways like Stripe, PayPal, or bank transfer.

- Make it easy for clients to pay from mobile or desktop.

- Follow up consistently, ideally with automated reminders.

A tool like Elorus simplifies this. In minutes, you can send branded invoices, connect to payment gateways, and trigger automated follow-ups for overdue accounts. That means fewer awkward collection calls and faster deposits.

2. Restructure your payment terms

Don't let your clients use your agency as a line of credit. Instead, require upfront deposits (usually 30–50%) before you begin work. Then, use milestone billing for long projects, like payments at kickoff, halfway, and at delivery.

Be transparent: position payment structure as part of how you deliver quality work on time. You can’t fix cash flow if all your income shows up after your expenses are already due.

3. Get a real-time view of your agency’s finances

If you’re relying on spreadsheets or quarterly reports, you’re too late. You need to know, in real-time:

- What’s been invoiced

- What’s been paid

- What’s overdue

- What’s about to go out

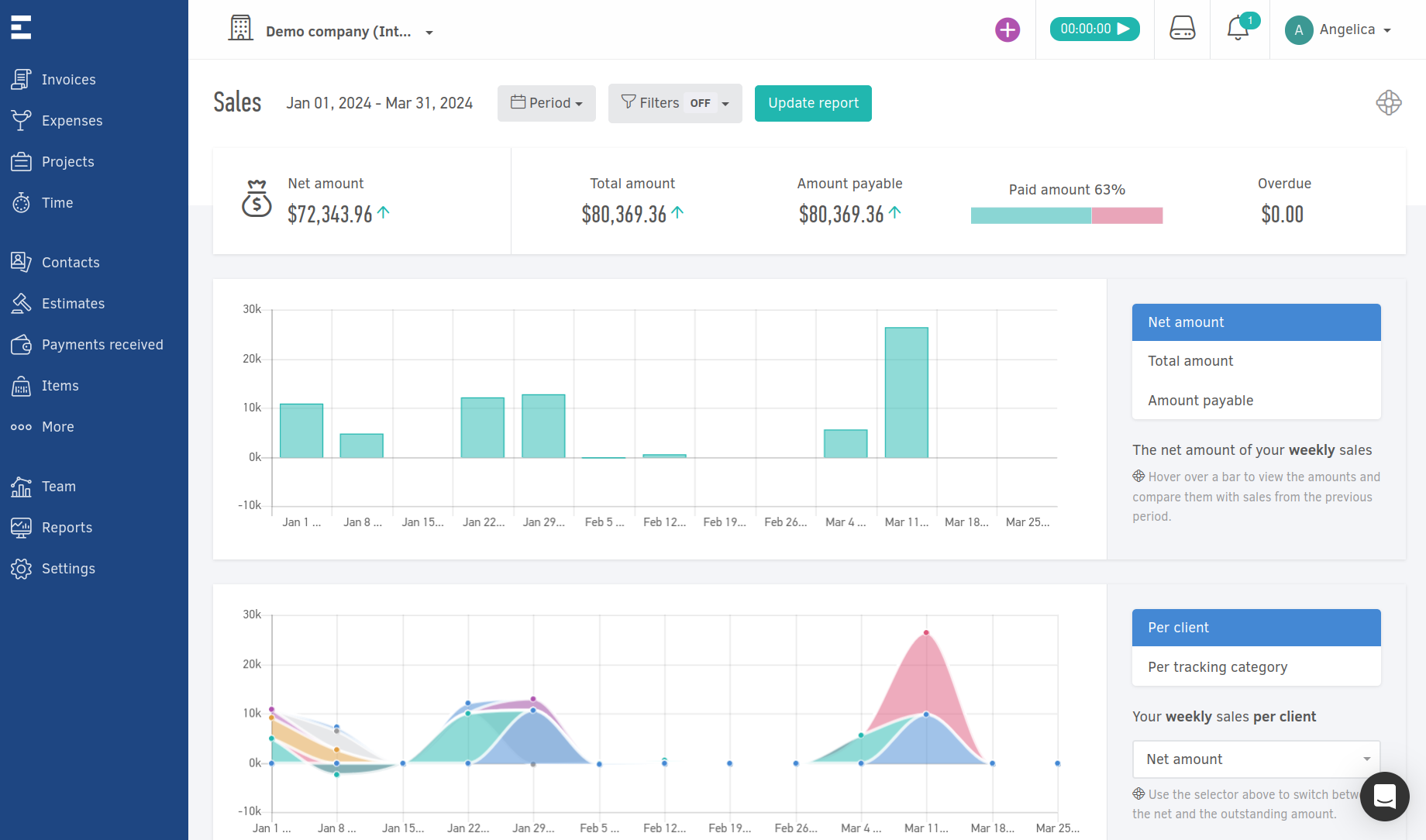

Elorus acts as your financial command center, giving you live dashboards that show cash flow trends, upcoming obligations, and client payment statuses. It replaces guesswork with clarity and helps you make better day-to-day decisions.

4. Track and categorize your expenses diligently

Where is your cash actually going? If you can’t answer that with confidence, it’s time to tighten things up. Elorus helps you with all aspects of expense management, including:

- Categorize expenses by project or client

- Capture receipts instantly using mobile tools

- Spot overages before they spiral

- Make better pricing and resourcing decisions

Also, when you tie spending to specific jobs, you’ll also improve profit forecasting and avoid undercharging for high-cost deliverables.

From profitable on paper to healthy in the bank

Profit is great for bragging rights. But cash is what keeps your business actually up and running.

When you understand the difference, and the sneaky ways your agency’s profit can mask deeper issues, you can take control. That starts with faster invoicing, smarter billing structures, better expense visibility, and ditching outdated tools.

Elorus gives you that visibility in real time. It helps you get paid faster, understand where your money is going, and confidently steer your agency through feasts and famines alike.

So stop wondering where the cash went and start making your business healthy on paper and in practice.